Three Internal Controls Every Cannabis Company Should Have

Internal controls - what’s the big deal for the cannabis industry specifically? Most cannabis companies are in the early stages of becoming a viable, profitable, long-term business which means the vast majority of their attention is being put to scale their operations. In addition, they are at the mercy of a compliance quagmire consisting of downright conflicting federal, state and local laws. Did I mention the rules of compliance can change literally at a moment’s notice? Given their unique situation, it's understandable why cannabis organizations don’t have a robust internal audit team reporting operating inefficiencies to their board of directors.

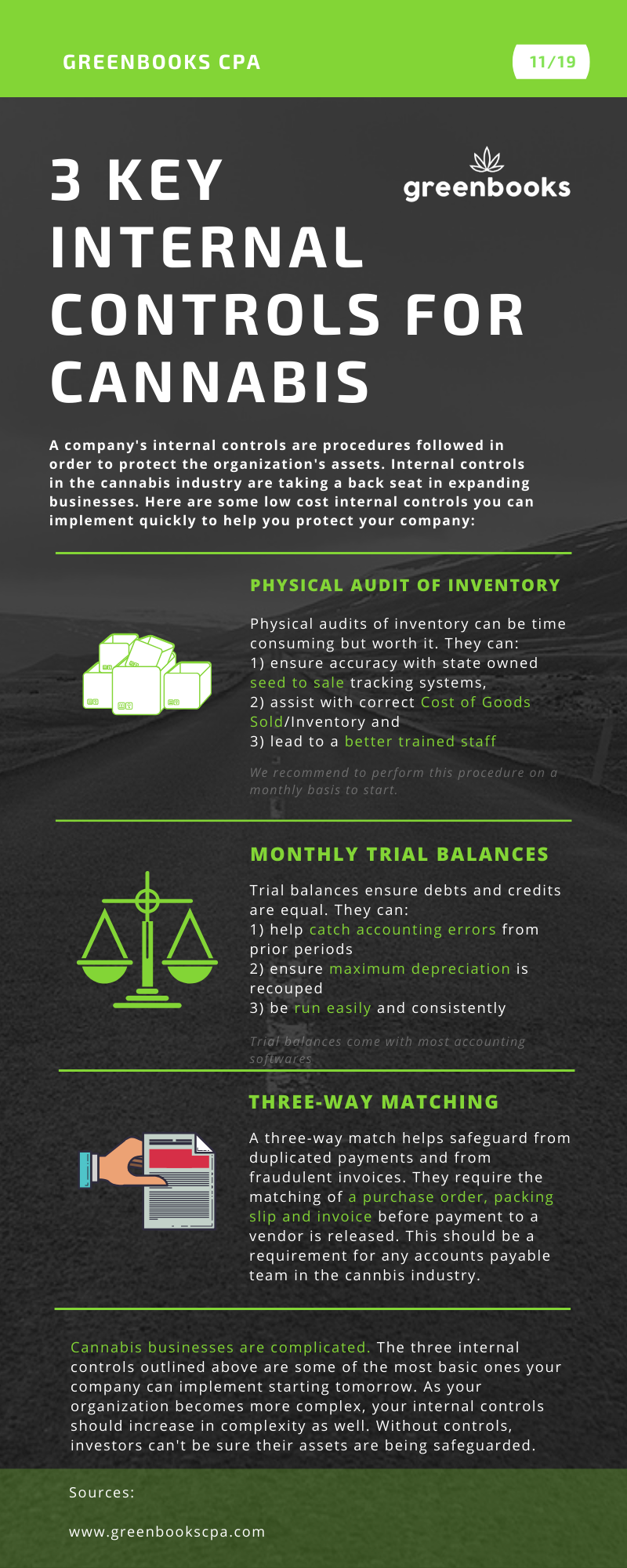

Should they though? Well, ask almost any CPA and the answer would be...almost certainly. A company's internal controls are procedures followed in order to protect the organization's assets. Given a large percentage of cannabis companies are funded by external investors, it seems realistic that folks would want assurance that their investment is being correctly monitored.

By far the biggest problem on everyone's mind is cash. Traditionally, cash is an account with a great deal of emphasis from an internal controls perspective, but it takes front and center stage in the cannabis industry. As we continue to tread the waters of finding reliable merchant services to handle cash receipts in a safe and consistent manner, we must pay extra attention to the account. This could mean developing physical controls, video surveillance, segregation of duties and good old fashioned spreadsheet tie-outs.

For purposes of this article, we’ll take a look at internal controls that secure assets other than cash, Unfortunately, until the SAFE act or a similar piece of legislation passes, cash will require its own series of articles to discuss at length. So, what are some of the most important internal controls every cannabis company should have?

Some of the important concepts we’ll cover in this article

#1) Regular Physical Audit of Inventory

A regularly scheduled physical audit of inventory should be a no-brainer in this industry. Although it can be a pain, taking both time and money to perform, the behavior it instills in an organization will pay off in spades. A few benefits your company would get from installing this procedure include more accurate seed to sale tracking, an increased accuracy in your stated cost of goods sold and inventory accounts as well as a better trained and monitored staff.

As we know, every state with legalized recreational marijuana use requires companies to use state software to track cannabis in its inventory from “seed to sale”. These softwares are often difficult to use and don’t naturally integrate into most common accounting softwares, making them the bane of our existence. While we wait for states to improve upon their software or even third party solutions to help us integrate, we are expected to accurately input values into these trackers. Indeed, in many states, accurate usage is linked to licensure which means cannabis companies could potentially lose their license due to a material misstatement. Regular physical audits of inventory should be a part of all cannabis organizations that are subject to “seed to sale” tracking as one of the first and principal duties of any cannabis company should be to hold on to its license.

Switching gears to tax world for just a second, the most hotly contested line item by the IRS this year is without a doubt Cost of Goods Sold. The IRS has been preying on this line particularly when it comes to cannabis companies as they are aware it is the only business deduction allowable to us under section 280e. Unfortunately for us, the tax court has ruled overwhelmingly in their favor on this issue. The message to everyone in the sector is clear - your cost of goods sold, and therefore inventory, line items better be accurate if you want to avoid large penalties, fees and fines. A physical audit of inventory is going to go a long way for your accounting systems when it comes to these two line items. Setting up the correct accounting workflow is difficult enough - showing documentation of consistent inventory audits to the IRS could go a long way towards soothing their concerns.

The third benefit is one that should not be underlooked - a better trained and professional staff. As regular physical audits of inventory become a standard procedure in your organization, your employees will begin to shift their behavior in advance of the audit. They will become accustomed to the internal auditor’s procedures and checklist and as time goes on, become more efficient in the process. Over time, it also gives them the opportunity to think of their job in the bigger picture of the organization, possibly allowing a promotion path for stand-out employees.

Physical audits of inventory - do them consistently and reap the benefits in a short period.

#2) Monthly Trial Balances

Monthly trial balances could be broadly categorized as “regular reconciliations of major accounts''. We believe this is the bare minimum control that any organization must institute before they can claim they have reliable financial records. A tied-out, monthly, trial balance can serve as a starting point for further optimizing of an organization’s accounting department. There are three primary benefits to include a monthly trial balance into your internal controls: first, accounts must tie out historically. Secondly, it ensures accurate depreciation schedules and finally, it should be relatively easy to put together.

One of the simultaneously beautiful and ugly concepts about a trial balance is that it requires previous accounting periods to tie out in order to work correctly. One of the reasons this is advantageous is it allows you to take a quick snapshot of your accountant’s work on the fly. If an account seems incorrect such as Shareholder’s Equity, asking to see a trial balance for previous periods can help you discover any possible accounting errors made in the past.

A secondary huge advantage of a trial balance is that running them over several periods can help determine if your depreciation schedules make sense. Depreciation is a hugely important expense to capture and maximize as it is a non-cash expense for usage of fixed assets. The problem in the cannabis industry is that any fixed assets allocated to the cannabis division of your organization are technically not allowed to take the expense as a tax write-off. It should be of paramount importance to ensure that your fixed assets are appropriately divided into the cannabis and non-cannabis divisions of your company. Reviewing your trial balance values on a monthly basis serves as an important gut-check if the allocations as well as overall methods of depreciation are being performed correctly and consistently.

So far in this article, we’ve recommended two internal controls every cannabis company have. One of them potentially requires a well-thought out, carefully executed plan that will ultimately end up being a time sink the first few times around. The other, is a trial balance. While the cost-benefit ratio of a physical audit of inventory is no doubt worth it, a trial balance must blow it out of the water. In any decently run accounting organization, a trial balance should take minimal effort and time to put together. Give your accounting department an afternoon to put together a trial balance - if they can’t do it, you might be in bigger trouble than you think!

A monthly trial balance combined with a regular physical audit of inventory can be a strong 1-2 combo for any organization looking to maintain accurate records. What other control can we install to ensure we are protecting the company’s assets?

Easy, cheap, efficient and helpful - the perfect internal control?

#3) Three-Way Matching

One of the most basic financial controls in the non-cannabis industry, three-way matching is a very powerful preventative control used to organize accounts payable. The essential gist behind a three-way match is we want to prevent the organization from paying erroneous or falsified invoices, especially as the volume of payments increases.

Let’s envision a scenario of purchasing a new set of LED lights with a typical accounts payable workflow that includes a three-way match. Once the cannabis company has selected its vendor, it issues a purchase order. The purpose of this document is to confirm the order - it would include the vendor name, the type and quantity of lights, how much each light costs and a purchase order number. When the LED lights arrive at the warehouse, upon opening the package, the cannabis employee should find a packing slip inside the box. The packing slip is the proof of payment and delivery. An order receipt is included by the vendor with goods that have been delivered to the purchaser. It details exactly what is in the shipment or order. Finally, the vendor will send an invoice to us, which is a third and final document. They include the same information as in the purchase order, as well as an invoice number, vendor contact information, any credits or discounts for early payments, payment schedule, and total amount due to the vendor.

The requirement of any good accounts payable would require a three-way match between all three documents prior to release of funds. Many cannabis companies do not have a three-way match as they simply don’t have the staff to handle the workload. This is a huge mistake. Not including all three documents as well as a required match of the documents before disbursing payment is setting your organization up for theft, fraud and huge cash windfall.

This isn’t even a control so much as a requirement for any company.

These three internal controls were selected as they only start to scratch the bare minimum of what we think cannabis companies should require. One of our services is outsourced internal audit where we work together with our customers to install internal controls in to their organization. With everyone in the industry looking for short term profit grabs, these are some of the basic cornerstones of building a successful long-term business.